The Universal EV Production System at Louisville

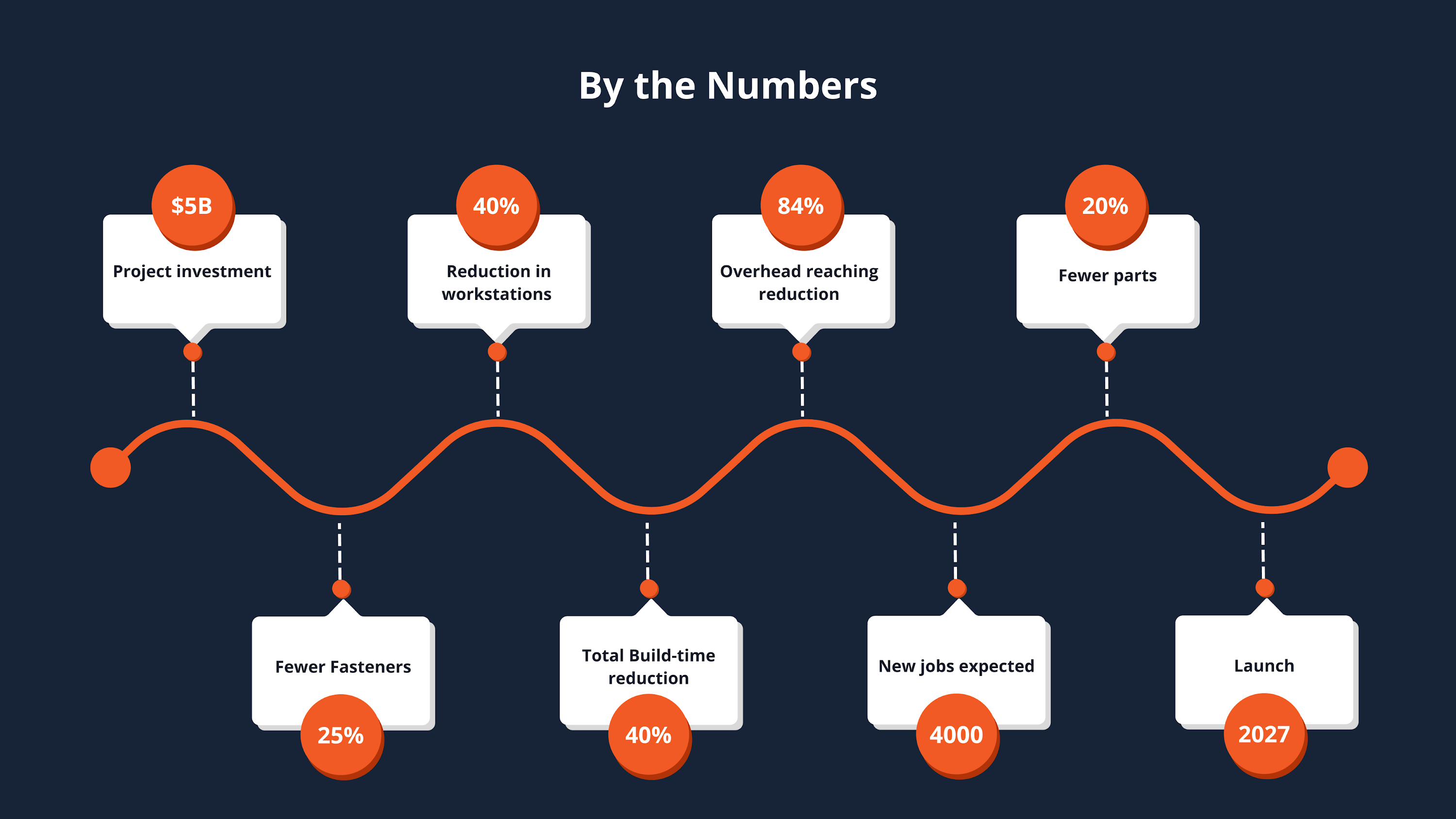

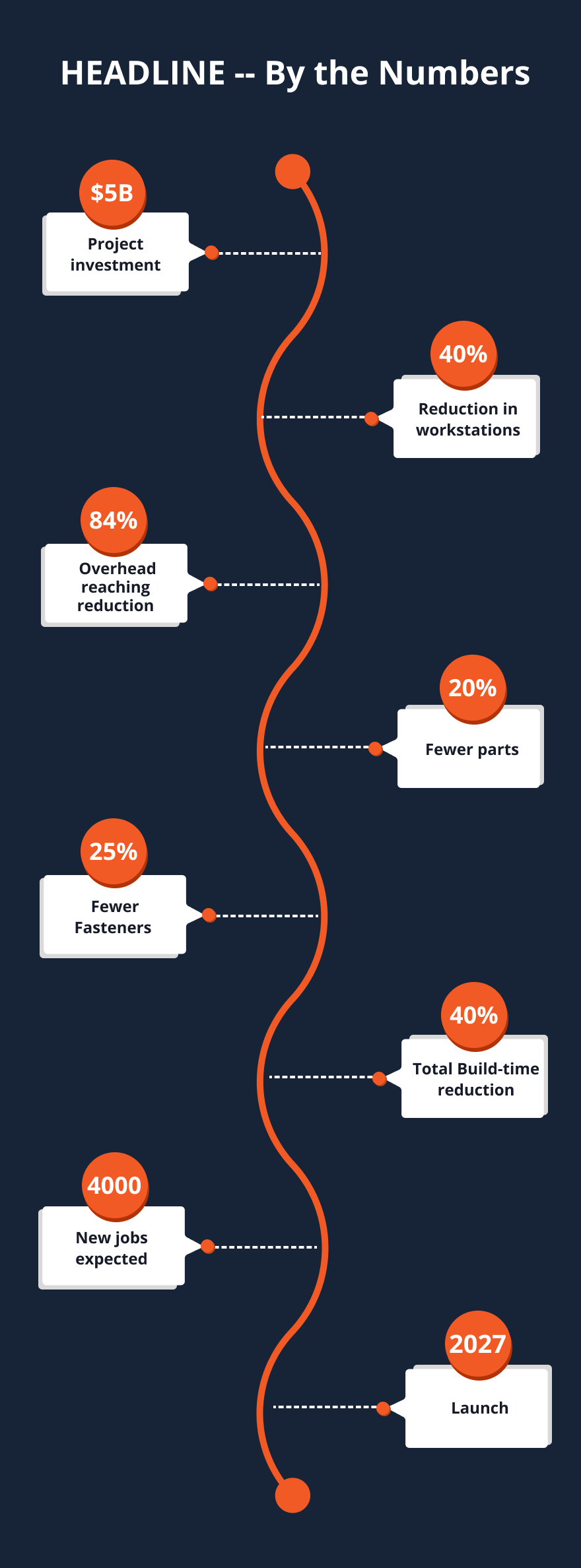

Ford Motor Company announced in August a sweeping $5 billion plan to reinvent its vehicle manufacturing process, centered on a radical overhaul of the Louisville Assembly Plant.

The plant, which currently builds traditional internal combustion models like the Ford Escape and Lincoln Corsair, will be retooled to produce next-generation electric vehicles (EVs) starting in 2027.

The company expects to invest $2 billion in the Louisville plant’s changeover and another $3 billion in a new battery factory, the BlueOval Battery Park Michigan, to supply advanced EV batteries.

The bold investment signals what many are calling a “Model T moment” for Ford, a once-in-a-generation reset of auto manufacturing comparable in significance to Henry Ford’s original assembly line revolution over a century ago.

In short, Ford’s new Universal EV Production System is poised to redefine how cars are built in America, with profound implications for automotive suppliers and contract manufacturers across the industry.

The New Manufacturing Paradigm: Assembly Tree and Modular Sub-Assemblies

At the heart of Ford’s overhaul is a completely new assembly process. Instead of the classic single-moving assembly line, the Louisville operation will use an “assembly tree” layout comprised of three parallel sub-assembly lines that merge at final assembly.

In this modular system, the front, rear, and middle sections of the vehicle, housing the structural battery pack, interior seats, and flooring, are all built simultaneously on separate lines and then joined as a complete vehicle.

This concurrent approach slashes overall assembly time, allowing multiple teams and robots to work in parallel. Ford estimates the new system will cut total vehicle build time by up to 40%, and even after reinvesting some time into quality checks and automation, final assembly is 15% faster than the plant’s current throughput.

Beyond Speed

This new approach offers significant benefits beyond cycle time. It greatly reduces complexity on the factory floor.

Ford will eliminate nearly 40% of the typical workstations by delivering sub-assemblies in pre-fabricated modules. Operators at each station receive parts as a prepared “kit,” complete with the correct orientation and even tools at hand, minimizing wasted motion and errors.

Workers gain unobstructed access to components instead of contorting their bodies around an unfinished car moving down a line. This results in a more ergonomic process with far less bending, reaching, and straining for staff. This enhances worker safety and reduces lost-time injuries.

In fact, engineers report an estimated 84% reduction in overhead reaching for workers thanks to smarter positioning of parts and tools. By putting operator comfort first, Ford expects to see improvements in build quality and consistency as well.

“Moves like Ford’s challenge every supplier to think bigger. This isn’t just about keeping up. It’s about redesigning how we build, measure, and deliver at every step of the process,” said Eric Cline, Owner of PMi2, a machining and automation solutions provider in Seneca, South Carolina.

Crucially, Ford’s vehicle design itself has been optimized for this modular assembly method. The company’s new universal EV platform uses large single-piece aluminum castings, what the company calls “unicastings” for major sections of the vehicle frame. These huge castings combine what used to be dozens of separate parts into one unit, drastically reducing the number of individual pieces that must be manufactured and assembled. Thanks to this design, Ford’s upcoming EV will use 20% fewer parts and 25% fewer fasteners than a comparable vehicle today.

Some reports indicate the new pickup’s body structure has cut about two-thirds of the welds and three-quarters of the components versus a traditional truck frame. Fewer parts and welds translate to fewer opportunities for defects, a lighter vehicle, and a simpler supply chain.

In short, Ford’s assembly tree and modular sub-assemblies represent a new manufacturing playbook, one combining EV production technology with lean design to build more efficiently than ever before.

Impact on Suppliers and Production Services

Ford’s aggressive simplification of vehicle architecture will send shockwaves through its supplier network.

In the past, a complex vehicle might require hundreds of small components from myriad Tier-1 and Tier-2 suppliers. Now, larger integrated modules like an entire front body section or a complete battery pack unit will arrive at the plant to be married in just a few big steps.

“Moves like Ford’s challenge every supplier to think bigger. This isn’t just about keeping up. It’s about redesigning how we build, measure, and deliver at every step of the process.”

— Eric Cline, Owner of PMi2

This reduced complexity means suppliers will be expected to deliver high-precision, pre-assembled components that fit perfectly into Ford's modules. Tier-1 suppliers with expertise in advanced casting, moldings, or modular assemblies stand to gain new business, while suppliers of many small brackets and sub-parts may see demand shrink.

In essence, the supply chain is shifting toward fewer, more integrated parts, and each of those parts must be manufactured to extremely tight tolerances and quality standards from the start.

For automotive suppliers and contract manufacturers, this trend brings challenges and opportunities. Meeting Ford’s needs will require cutting-edge machining and fabrication capabilities. Producing large unicast components or multi-component modules calls for advanced machining in EV production, such as precision CNC machining of cast aluminum sections or laser welding of battery enclosures.

Companies that can provide these precision machining services and maintain ISO-certified quality will become invaluable partners in the new ecosystem. For example, firms like PMi2 that offer specialized machining services for tight-tolerance components are poised to support the demand for highly accurate, integrated EV parts.

Meanwhile, automation and digitalization are becoming mandatory across the supply chain. Ford’s Louisville plant itself will have the highest level of robotics and automation in any Ford factory, and that expectation extends to its vendors.

| Good News for Suppliers | Challenges for Suppliers |

|

|

Suppliers will need to invest in robotics in EV manufacturing, from robotic assembly cells to automated inspection systems, to achieve the consistency and throughput required. Many are already deploying machine vision and AI-driven quality checks to ensure error-free modules.

Additionally, EV supply chain integration will tighten. Ford will rely on sophisticated Manufacturing Execution Systems (MES) and traceability software to coordinate the flow of sub-assemblies from various sources into the final assembly “tree.” Suppliers must be digitally plugged into Ford’s system, providing real-time production data, shipment tracking, and quality records for each batch of components. This end-to-end connectivity allows for just-in-time delivery and immediate troubleshooting if any part falls out of spec.

Production service providers and contract manufacturers also face a need to adapt their workflows.

The old model of building parts in large batches and holding inventory is giving way to synchronized, on-demand production. When Louisville’s lines are running, each sub-assembly has to arrive at precisely the right moment. Tighter scheduling and logistic coordination will be crucial, pressuring suppliers to streamline their internal processes to avoid being the bottleneck.

Companies can expect closer collaboration contracts, where suppliers are “virtually inside” Ford’s production schedule. In return, Ford’s simplification can reduce the chance of sudden design changes or surprise part shortages, since there are fewer moving pieces overall.

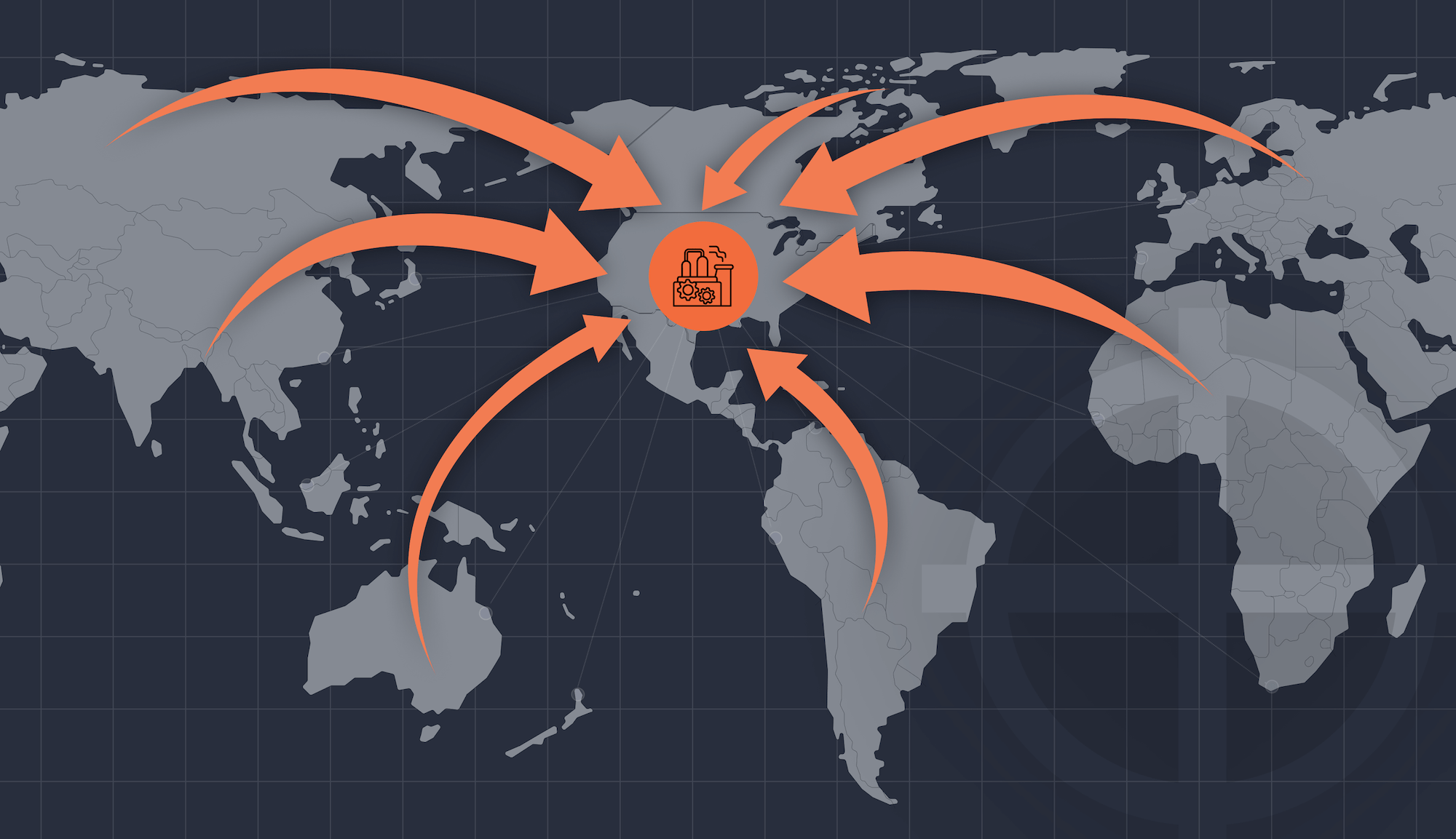

Notably, Ford has indicated that this EV manufacturing shift will expand domestic supplier involvement. By localizing battery production and other key modules in the U.S., Ford expects to strengthen its domestic supply base with dozens of new U.S.-based suppliers entering the fold.

This could be a boon for American manufacturing partners ready to deliver the required technology. Overall, the EV manufacturing supply chain trends emerging from Ford’s experiment point to a future where successful suppliers are those who embrace automation, digital integration, and precision production services to meet the new standard of simplicity and quality.

Integration of Affordable Battery Technology

A cornerstone of Ford’s Louisville overhaul is the pairing of vehicle assembly innovations with advances in battery technology. The next-generation EVs coming out of Louisville will be powered by new lithium iron phosphate (LFP) battery packs supplied from Ford’s BlueOval Battery Park in Michigan.

These LFP batteries are cobalt-free and nickel-free, making them significantly cheaper and more sustainable than the nickel-rich batteries used in many current EVs. By producing LFP cells domestically at its own facility, Ford ensures a stable supply of affordable batteries for its mid-priced EVs and reduces reliance on imported materials.

These LFP batteries are cobalt-free and nickel-free, making them significantly cheaper and more sustainable than the nickel-rich batteries used in many current EVs. By producing LFP cells domestically at its own facility, Ford ensures a stable supply of affordable batteries for its mid-priced EVs and reduces reliance on imported materials.

The battery packs themselves are not just power sources, but an integral part of the vehicle’s structure.

Ford's new platform uses a structural battery pack design: the LFP battery module is built as a flat, rigid section that doubles as the floor and spine of the truck's chassis.

In the Louisville assembly tree, this battery-with-floor section is one of the three main sub-assemblies — the “middle” branch of the tree.

Integrated Battery Yields Multiple Benefits

Ford’s smarter battery integration offers multiple benefits that enhance manufacturing efficiency, vehicle performance, and usability.

- The battery is installed as a single structural unit, speeding up assembly and reducing complexity.

- The pack acts as a load-bearing element, improving vehicle rigidity and lowering the center of gravity for better handling.

- Reduced parts and fewer fasteners streamline production, cutting assembly time and cost.

- This design frees up interior space, allowing Ford’s midsize electric pickup to offer passenger space comparable to larger vehicles.

- The battery size can be up to one-third smaller than competitors’ while achieving similar driving range, reducing weight and cost," is clearer and technically appropriate.

- The compact battery enables a quieter cabin and enhances overall vehicle durability.

These engineering advances contribute to a more affordable, efficient, and enjoyable electric vehicle experience for customers. This integration is central to Ford’s new Universal EV Platform and Louisville plant production strategy, promising innovation that echoes historic manufacturing breakthroughs.

From a supplier perspective, the focus on LFP batteries and structural integration carries implications. Battery cells will be manufactured at BlueOval Battery Park Michigan starting in 2026, meaning battery cell production is essentially an internal supply chain feeding the Louisville plant.

Suppliers involved in this process, from those providing raw battery materials to those building battery management electronics, will be working in lockstep with Ford’s production schedule. The structural nature of the pack also means that battery enclosure and assembly must meet automotive-grade tolerances and safety standards.

This could create opportunities for firms that make battery casings, cooling systems, or electronics to be involved earlier in vehicle design. Moreover, handling and shipping these battery modules from Michigan to Kentucky will require robust logistics and safety protocols, likely involving specialized transport and handling equipment.

Ford’s integration of affordable battery tech demonstrates how the EV supply chain is evolving into a more vertically integrated and collaborative model, where battery production, vehicle assembly, and suppliers operate in a tightly coordinated ecosystem.

Workforce Transformation in the New Production System

As Ford embraces automation and streamlined assembly, the workforce at Louisville and its partners will undergo a significant transformation. The Universal EV Production System is highly automated, incorporating more robots and cobots, advanced controls, and real-time data systems than any previous Ford plant.

Consequently, the overall number of assembly line workers required will be lower than in a traditional plant of similar capacity. Ford acknowledges that certain repetitive or strenuous tasks are being offloaded to machines.

Transformation and Training Changes

- Shift to higher-skilled roles

- Upskilling and training programs

- Virtual/Augmented Reality tools

- Ergonomic improvements

- Workforce downsizing balanced with job creation

- Collaborative approach with unions

- Focus on continuous improvement

Importantly, though, human workers are not being removed from the equation, rather being elevated to new roles. The jobs in this revamped plant skew toward higher-skilled, tech-enabled positions. Instead of hundreds of workers doing simple installs with wrenches, the plant will need more robotics technicians, automation engineers, quality control analysts, and multi-skilled operators who oversee automated cells.

To support this shift, Ford is investing in training and upskilling programs for its employees.

Many Louisville workers will be retrained to program and maintain robots, use advanced manufacturing execution software, and interpret data from digital quality systems. The company is reportedly introducing virtual reality (VR) and augmented reality (AR) tools to help train employees on the new assembly processes in a safe, controlled environment.

Immersive training can simulate the assembly tree workflow and teach workers how to work alongside cobots, short for collaborative robots, or how to perform complex tasks on modular assemblies. By the time the retooled plant launches, Ford aims to have its team fluent in the new technologies. This commitment to workforce development resonates with the broader concept of “Workforce 4.0” where human workers and AI-driven machines collaborate closely, each augmenting the other’s strengths.

Another emphasis is on ergonomics and safety. Ford’s design of the assembly tree was very much influenced by what line workers said they needed. By delivering parts in optimal orientations and using assistive devices, the new engineered process reduces physical strain on workers at every station.

For example, heavy components might be presented at waist height using automated lifts, or difficult fastenings might be done by torque-assist tools instead of pure muscle. The reduction in twisting and reaching protects workers from injuries and improves their focus and job satisfaction, leading to better quality work.

Broader Implications for U.S. Manufacturing

Ford’s Louisville project is more than just one factory’s upgrade. It’s a bold blueprint that could influence manufacturing across the United States. By proving out a faster, more flexible way to build EVs at scale, Ford is effectively challenging legacy assembly methods industry-wide.

If this “assembly tree” approach delivers on its promises of efficiency and cost reduction, other automakers will feel pressure to adopt similar modular assembly strategies or risk falling behind.

Shaping the Future

- New standards via modular, parallel assembly

- Localized supply chains

- Faster automation and Industry 4.0 adoption

- Growing pressure to innovate and modernize

- Competitors adopting flexible, scalable production

- Expansion of regional manufacturing hubs

- Focus on workforce development and digital integration

- Accelerated modernization with policy support

Ford’s rivals likely will be exploring their own versions of large casted frames, parallel assembly lines, or deeper integration between design and production. In that sense, Louisville is a test case that could accelerate a nationwide shift toward lean, high-tech manufacturing for EVs.

The ripple effects will extend to supplier networks as well.

Ford’s emphasis on local, agile suppliers could encourage more OEMs to develop domestic supply chain capacity for critical EV components like batteries, electronics, and specialty castings.

Recent trends in the automotive industry already point toward localization and near-shoring of supply chains, to reduce geopolitical risks and to shorten delivery times for just-in-time manufacturing.

“Manufacturers that adapt to this new model of precision and automation aren’t just future‑proofing their operations—they’re defining the new standard for American manufacturing.”

— Eric Cline, Owner of PMi2

Ford’s move strengthens that trend by demonstrating how a tight geographic integration can be a competitive advantage. This reduces shipping costs and buffers against international supply disruptions, making the whole production ecosystem more resilient. Regions with strong supplier bases in the Midwest and Southeast might experience growth as more automakers invest in localized EV production hubs.

The technology bar for manufacturing is also rising. Ford’s project showcases the benefits of embracing Industry 4.0 principles, including IoT connectivity, AI-powered systems, and digital twins, to create smart factories.

As these capabilities prove their value in quality and output, they’ll likely become standard expectations in new factory projects. Smaller suppliers and contract manufacturers around the country may need to upgrade their equipment to remain part of such advanced production networks.

For U.S. manufacturing at large, this could spark a new wave of industrial modernization, supported by investments in worker training and perhaps government incentives.

Automation Solutions

Boost productivity and ROI with labor-saving automation that simplifies your manufacturing process.

Discuss Automation

Future Outlook: A Flexible, Profitable, Scalable EV Production Model

Ford’s endgame for the Louisville experiment is clear: create an EV manufacturing model that is flexible, profitable, and scalable for the mass market. The company has already revealed that the first product from the new system will be a mid-sized electric pickup truck with a target price around $30,000, slated for 2027.

“Manufacturers that adapt to this new model of precision and automation aren’t just future‑proofing their operations. They’re defining the new standard for American manufacturing,” said Cline.

Hitting that aggressive price point is critical for Ford to capture a broad customer base, and it largely hinges on the production savings and efficiencies from the Universal EV Platform and assembly tree system. By cutting out complexity and embracing advanced automation, Ford aims to significantly lower the per-vehicle production cost compared to today’s EVs, which should enable lower sticker prices without sacrificing margin.

If Louisville can profitably build an affordable electric truck at scale, it will validate this new production approach and allow Ford to rapidly expand its EV lineup using the same playbook.

Industry observers are watching closely to see how competitors respond.

It’s very likely that elements of Ford’s strategy, such as giga-casting large parts, using structural batteries, or parallel assembly workflows, will be studied if not outright emulated by other automakers. Expect General Motors, Stellantis, and international automakers to accelerate their own manufacturing innovations.

This could spark a healthy innovation race in automotive manufacturing, with each company seeking an edge in how efficiently and flexibly it can build EVs.

In the big picture, if Ford’s model succeeds, it proves that American manufacturers can invent new technologies and reinvent the way products are made at scale. A future where $30k electric pickups are feasible would have huge implications for EV adoption rates, market competition, and the auto supply chain.

Scale Your Contract Manufacturing

A New Playbook for American Automotive Manufacturing

Ford’s Louisville Assembly Plant reinvents automotive manufacturing with its “assembly tree” system. This cuts build times by up to 40%, with a net 15% gain after automation reinvestment.

Modular design cuts parts and connections by half, boosting quality and reducing costs.

The plant’s advanced digital infrastructure supports real-time quality checks. Ergonomic improvements reduce worker strain, enhancing safety and efficiency.

Louisville sets a new U.S. manufacturing standard—simpler, faster, and highly automated—balancing quality, speed, and cost.

It remains to be seen how suppliers will adapt to this new normal. Many will need to rapidly adjust operations and capabilities to meet Ford’s elevated demands on precision, automation, and coordination. The transition will likely bring disruption and opportunity as the supply chain evolves alongside the industry’s manufacturing revolution.

FAQs

It’s a new manufacturing process that Ford is debuting at its Louisville plant to build electric vehicles. Instead of a single assembly line, the system uses an “assembly tree” with three major sections of the vehicle built in parallel (front, rear, and a center section with the battery) and then joined together.

In a traditional assembly line, a vehicle moves down a conveyor with parts added one after another in sequence. Ford’s new method breaks the vehicle into large modules assembled simultaneously on separate lines. For example, the entire front end can be built at the same time as the rear end and the interior/battery section. They all come together at final assembly. This parallel process eliminates many intermediate steps, uses more automation and pre-fabrication, and results in a finished car coming together15% faster than their usual process.

Suppliers will need to adapt to Ford’s streamlined approach. Since the new vehicles use fewer individual parts and more integrated assemblies, Ford will rely on suppliers to provide more complex, ready-to-install modules and high-precision components. Suppliers may need to invest in advanced manufacturing tech to meet Ford’s quality standards and volume. The supply chain is likely to become more collaborative and digitally connected.