Tariffs Turn Up the Heat on CNC Reshoring and Sourcing

The COVID-19 pandemic went beyond disrupting the flow of semiconductors. It rattled global supply chains for precision parts, including CNC-machined components critical to aerospace and automotive industries. Borders closed, and factories struggled.

U.S. manufacturers found themselves scrambling, facing weeks-long delays, exploding costs, and financial losses, as lead times stretched and parts inventory dried up. The promise of “just-in-time” manufacturing became a scramble for “just-in-case” stockpiles.

The lesson was clear: Global supply chains increase risks for manufacturers. The pandemic was just the beginning.

Today, U.S. manufacturers face new threats in unpredictable tariffs, political unrest, and escalating geopolitical tensions.

In 2025 alone, tariffs on imports from Canada, Mexico, and China have surged, driving up costs for raw materials and finished parts. Political instability in regions like Eastern Europe and the Middle East has choked off shipping lanes and forced costly detours. At the same time, labor shortages and port strikes add even more uncertainty to the mix.

This article looks at why U.S. manufacturers should reconsider their reliance on overseas parts suppliers, and how domestic job shops can step up and leverage their precision machining capabilities to meet production demands.

Challenges of Relying on Machine Shops Overseas

While sourcing CNC-machined parts from overseas suppliers has long been viewed as a cost-saving strategy, the reality is more complicated and carries more risk.

"Reshoring gives us the chance to innovate faster and push the boundaries of what’s possible in precision manufacturing. It’s how we keep American manufacturers competitive on the world stage,” said Eric Cline, the owner of PMi2, a South Carolina automation integrator and machining company.

The potential benefits of reshoring increasingly position domestic machining shops as ideal partners for American manufacturers, as they fill production gaps and address mounting challenges that threaten their bottom lines and operational stability.

The Shipping Reality vs. Expectations

In an ideal world, receiving CNC-machined components from overseas would be a smooth, predictable process. But that’s a perfect world.

In reality, manufacturers often find themselves navigating delays, cost fluctuations, and logistical hurdles that make international sourcing anything but simple.

Ocean freight, the most common method for transporting CNC-machined parts, typically takes three to five weeks. Factors such as port congestion, customs processing, and unexpected shipping disruptions can push delivery times to six or even eight weeks.

The collapse of the Francis Scott Key Bridge in Baltimore significantly impacted supply chains, including the delivery of precision-machined components. The Port of Baltimore, a major hub for shipping, was effectively blocked, forcing manufacturers to reroute shipments to other East Coast ports.

The Maryland Chamber of Commerce estimated the bridge collapse cost the U.S. about $15 million a day in economic activity.

Some manufacturers opt for air freight for a faster turnaround, cutting time to just five to twenty days. While this speeds up delivery, the steep cost often makes it impractical for bulk shipments or cost-sensitive operations.

When combined with ocean shipping, manufacturers relying on global supply chains can expect turnaround times to regularly run up to two to three months.

Manufacturing and Delivery Estimates for Global Supply Chains

- CNC machining lead time: 4 to 6 weeks

- Ocean freight: 3 to 5 weeks

- Air freight: 5 to 20 days

- Total turnaround time: 2 to 3 months

Unexpected complications, ranging from policy shifts to transportation inefficiencies, often extend delivery timelines even further, making overseas sourcing a strategic risk for domestic OEMs.

The Illusion of Cost Savings vs. Escalating Risks

International suppliers attract U.S. companies who see the bottom-line benefit of lower production costs. But those savings inevitably evaporate as challenges arise.

- Tariff Volatility: Recent policy shifts have led to steep tariff hikes, which remain a moving target. China was hit with the highest tariff rate of 145%, leaving manufacturers reeling. These fees drive up costs and squeeze margins.

- Unpredictable Trade Policies: Sudden regulatory shifts disrupt supply chains overnight, creating uncertainty and making accurate budgeting and long-term planning nearly impossible.

- Rising Logistics and Shipping Costs: Global labor shortages, fuel price increases, and congested ports have contributed to rising expenses and delivery delays, ultimately negating any initial price advantage.

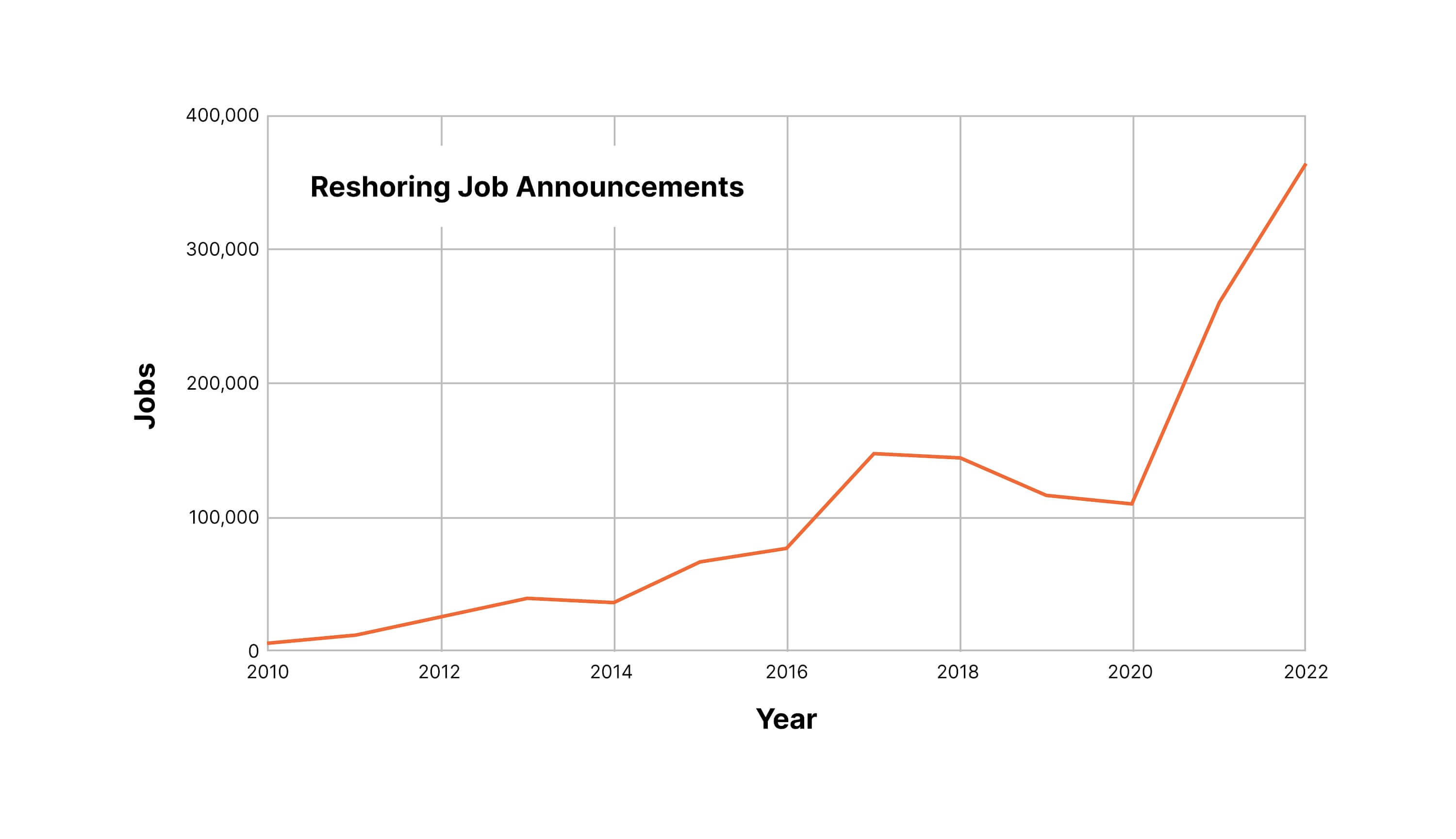

Why Reshoring Makes More Business Sense in 2025

The old model of chasing the lowest overseas price is increasingly unsustainable. Tariff uncertainty, political unrest, and logistical headaches exposed the fragility of global sourcing.

Reshoring flips the script, transforming these vulnerabilities into strategic advantages for American manufacturers that source parts and services domestically.

Reshoring is more than a defensive move. It’s a proactive strategy for growth, resilience, and leadership in a volatile world.

‘Local’ Advantages

Business relationships are simply easier to form and cultivate domestically, and the ability for a manufacturer to easily travel in-person to a supplier’s machining shop can be a huge advantage in precision industries, where projects more often involve complex parts and applications.

Stability Amid Tariff Uncertainty

By bringing upstream suppliers and production back to the U.S, domestic manufacturers sidestep unpredictable tariff hikes and trade policy swings, gaining cost stability and long-term planning confidence.

Financial and Operational Gains

Reshoring unlocks new tax incentives, reduces or eliminates shipping costs, and improves cash flow for manufacturers by minimizing their inventory buffers and lead times.

Quality and Compliance

Machine shops in the U.S. operate under strict regulatory standards, ensuring higher quality, faster response to design changes, and easier compliance for regulated industries.

Job Creation and Economic Security

Every reshored operation supports American jobs, strengthens local economies, and reinforces national security by reducing dependence on foreign sources.

Machining Services

Quality, accuracy, timely delivery, and innovative problem-solving keep your production on track.

View our capabilities

The Longer View of Domestic Sourcing

As manufacturers step back and look beyond the initial price tag, the value and ROI of reshoring suppliers and parts production become clear.

The cost per part is just one factor. Reshoring also creates a more stable, agile, risk-resistant supply chain that supports more sustainable growth and market competitiveness.

Cost Stability

Domestic sourcing shields manufacturers from chaotic tariff hikes and rollercoaster shipping rates. Financial predictability contributes to more accurate budgeting and pricing, better protecting profit margins, and limiting costly surprises.

Operational Agility

Partnering with local machine shops means shorter lead times and better communication. Manufacturers offer flexibility to adapt to market shifts, customize orders, and resolve issues faster, turning operational agility into a potent competitive edge.

Unique Expertise

Domestic suppliers are often pushing the boundaries of what’s possible in the field of precision machining, leveraging unique equipment and operational capabilities that make them ideal partners for manufacturers that need access to newer machining technologies or custom production applications.

Reduced Risk

Simplifying the supply chain reduces exposure to geopolitical tensions and global crises. The result is fewer delays, less downtime, and greater confidence in meeting customer commitments.

The strategic advantages of domestic sourcing extend beyond initial costs. It’s about building a resilient, responsive manufacturing foundation fortified against a rapidly changing and unstable world.

Meeting New Demand: How Machine Shops Must Step Up

The skilled labor shortage is the elephant in the room.

It’s the number one threat facing job shops and machine shops in 2025. And that was before the push for reshoring.

According to data from the United States Census Bureau’s Quarterly Survey of Plant Capacity (QSPC), about 20.6% of U.S. manufacturing plants in Q3 2024 reported being unable to operate at full capacity. The shortage of skilled labor or an insufficient workforce was cited as the primary reason.

"The labor shortage? It's not just a problem–it's a handbrake on the whole U.S. manufacturing comeback." - Eric Cline, Owner of PMi2 Inc.

CNC Shops are already stretched thin, and the pressure is only getting worse as reshoring accelerates. This crunch threatens the U.S. manufacturing comeback.

According to a joint study by the Manufacturing Institute and Deloitte, U.S. manufacturing could need as many as 3.8 million new employees by 2033, and up to half of those jobs could go unfilled if the skills gap isn't addressed.

The shortage of skilled machinists is nearly three times as large as a decade ago, and the gap continues to grow.

As U.S. manufacturers accelerate reshoring, machine shops face a surge in demand unlike anything seen in decades.

This presents a tremendous opportunity and a formidable challenge. To capture new business, shops must scale up their capabilities, invest in technology, and, most critically, address the acute shortage of skilled machinists.

Strategies for Machine Shops

Reskilling and retraining efforts have been underway for years, with apprentices and career changers filling gaps in the skilled workforce.

As reshoring accelerates and demand rises, automation emerges as the more sustainable solution to manufacturing's labor challenges.

While apprenticeships remain valuable, automation is the most realistic path forward. The industry isn't just searching for skilled hands—it's preparing workers to collaborate with advanced manufacturing technologies for greater efficiency, precision, and long-term resilience.

- Automation First: Rather than new hires, machine shops prioritize robotics and automated systems to handle repetitive, high-volume tasks, ensuring consistent output in the face of labor challenges.

- Apprenticeship Programs with Real-World Focus: While training initiatives continue, there's a growing emphasis on integrating automation skills early. Apprentices are learning to operate, program, and troubleshoot CNC systems, ensuring that human expertise aligns with advanced technology.

- Reskilling from Within: Experienced workers aren’t just transitioning into machining roles—they’re being trained to work alongside automated systems, bridging the gap between traditional craftsmanship and digital precision.

- Optimize Machine-to-Operator Ratios: By leveraging technology and smart scheduling, shops can enable operators to manage multiple machines, boosting productivity even with limited staff.

Overseas Supplies On Shaky Ground at Best

For U.S. manufacturers, local sourcing of CNC-produced components forges a path to resilience, agility, and growth.

Domestic sourcing offers more cost stability, faster turnaround, and protection from global shocks while fueling American jobs and innovation.

The opportunity comes with urgency.

Machine shops must invest in automation, expand capacity, and close the skilled labor gap to capture this wave of demand. Those who adapt will lead a new era of American manufacturing strength—those who hesitate risk being left behind.

The future belongs to those ready to step up and make reshoring their competitive edge.